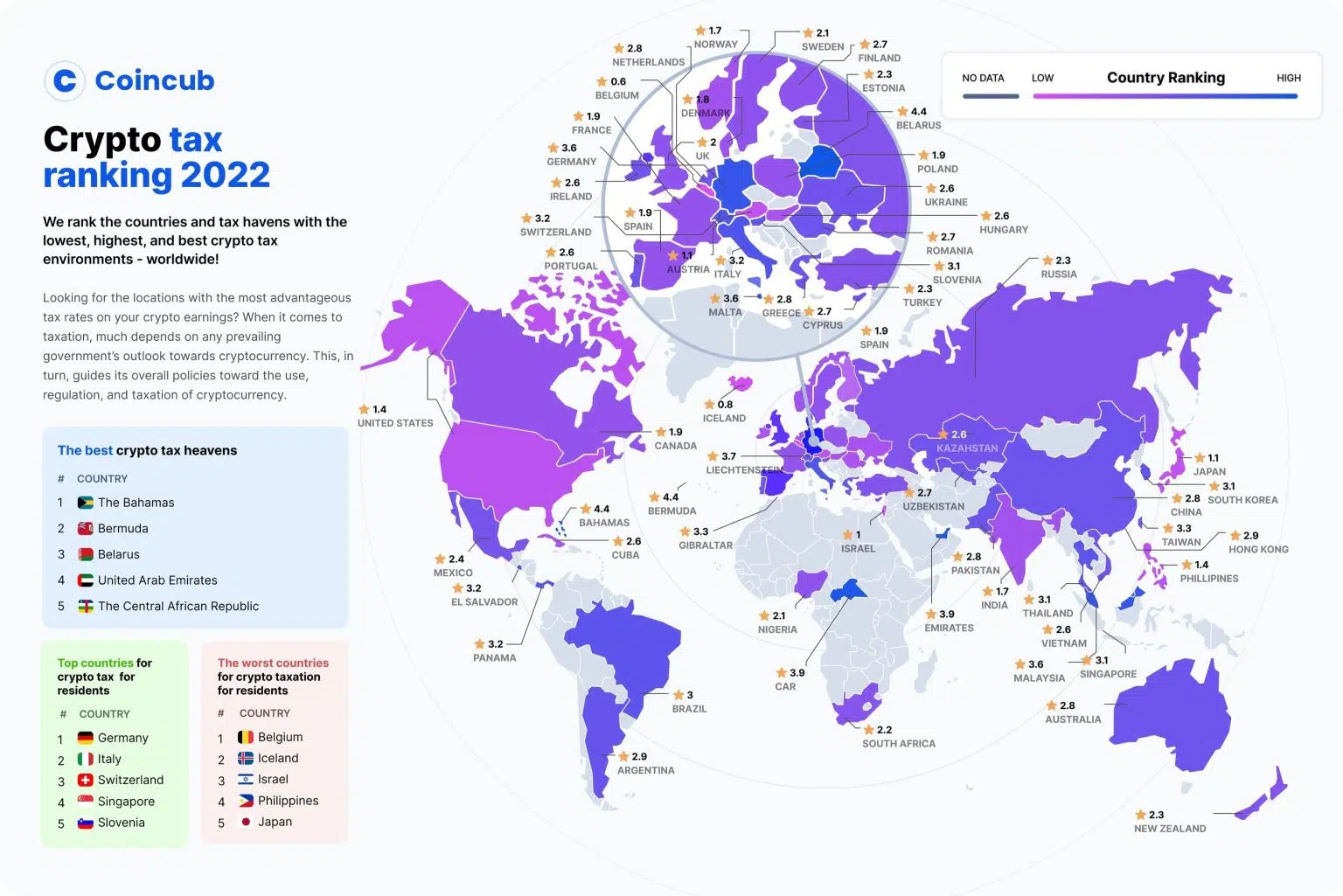

Taxation, a competitiveness issue? A report by Coincub on the taxation of crypto-assets makes a detailed comparison between countries, showing Germany as the country with the most favorable taxation. True to its tradition of financial savings, our neighbor does not tax your BTC if you have held them for more than a year.

The report also looks at the countries with the softest (and heaviest) taxation on cryptos.

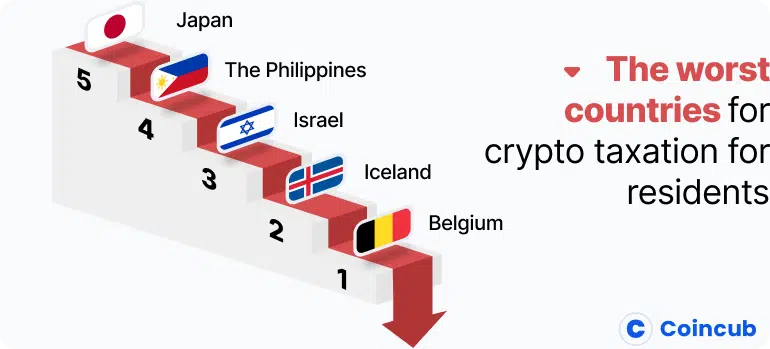

Belgium: the country with the highest taxation on crypto-assets

Belgium tops the list of countries where the tax authorities have the heaviest hand on capital gains related to crypto-assets. The Kingdom has implemented a 33% tax policy on capital gains generated by individuals.

For those who fall into the category of professional investors, the tax pressure even rises to 50%.

Behind Belgium, we find unexpected countries:

- Iceland: when gains exceed $7,000, they are subject to 40% tax. The scale is progressive and reaches 46% on the highest income level.

- Israel: also progressive, up to 33%.

- The Philippines: when earnings exceed $4500, they are subject to 35% tax.

- Japan: progressive scale, with a tax rate ranging from 5 to 45%, depending on income levels.

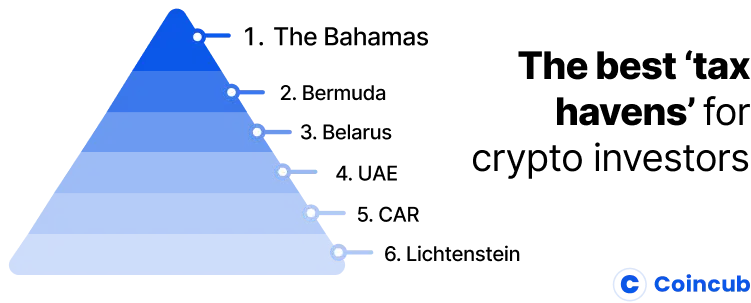

The Bahamas: tax haven for crypto-investors

At the top of the ranking are two states known for their accommodating tax system: the Bahamas and Bermuda.

In the Bahamas, tax obligations are minimal, at best simply declaratory. There is no tax to pay on capital gains for individuals, and for professionals a flat minimum tax that is not very significant.

Behind the archipelago there are well known jurisdictions and other more surprising ones:

- Bermuda: a country known for housing the international subsidiary of FTX, the country applies the same conditions as the Bahamas, but has a very advanced regulatory framework for crypto-assets.

- Belarus: the country went against its neighbors in 2018 by legalizing cryptocurrencies and stablecoins, and exempting individuals and professionals from capital gains tax until 2023.

- The United Arab Emirates: having created a Crypto Valley with 0% tax, the Emirates hopes to become a hub for the digital economy. They have even partnered with Switzerland to develop their attractiveness to cryptocurrency giants.

- Central African Republic: a country in the CFA zone that, despite recent announcements including the legalization of Bitcoin, seems mostly influenced by Russian foreign policy.

France is also among the states with high tax pressure on crypto-assets

Unsurprisingly, the French tax authorities are also among the scarecrows on a European scale.

It will be recalled that in France, capital gains tax is applied once you exceed 305 euros of gains in a year. 30% tax is then deducted from your tax base if you fall into the category of “occasional traders”. This rate increases to 45% if you fall into the category of “professional traders”.